NHU Thi Thao Hoang (Ms.)

Legal Assistant

E: nhu.htt@tndlegal.com

W: www.tndlegal.com

Profile: LinkedIn

In May 2020, Decree 35/2020/ND-CP on detailed regulations for implementation of the 2018 Law on Competition issued by the Vietnamese Government on 24 March 2020 (the Decree 35) has come into effect. As Decree 35 introduced a wider outreach on the transactions subject to merger filing requirement to be conducted with the National Competition Authority (the NCC), mergers & acquisitions (M&A) transactions in or partly related to Vietnam are forecasted to be significantly affected.By this article, the author aims topresenta brief on economic concentration’sregulations applicable to those intendingto participate in an M&A transactionwholly or partly related to Vietnam. For avoidance of doubt, the selected subjects of this article shall be exclusive of credit institutions, insurance companies and securities companies.

Economic concentration and notification threshold

Under the 2018 Law on Competition , the merger control regime refers to the control of economic concentration which can take any of the following forms:

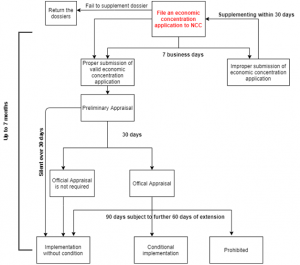

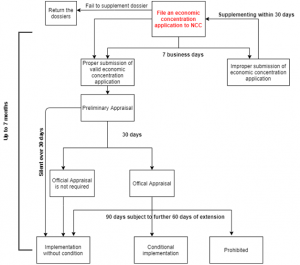

A description on the procedures for notifying the economic concentration

The procedures include two phases: (i) Preliminary appraisal and (ii) Official appraisal. In which:

Phase 1 – Preliminary appraisal

A description on the procedures for notifying the economic concentration

The procedures include two phases: (i) Preliminary appraisal and (ii) Official appraisal. In which:

Phase 1 – Preliminary appraisal

- Mergers;

- Consolidations;

- Acquisitions;

- Joint ventures; or Other kinds of economic concentration provided by law.

A description on the procedures for notifying the economic concentration

The procedures include two phases: (i) Preliminary appraisal and (ii) Official appraisal. In which:

Phase 1 – Preliminary appraisal

A description on the procedures for notifying the economic concentration

The procedures include two phases: (i) Preliminary appraisal and (ii) Official appraisal. In which:

Phase 1 – Preliminary appraisal

- The parties intending to participate in an economic concentration transaction shall submit the application for economic concentration to the NCC which comprises of the documents stated in Article 34.1 of the 2018 Law on Competition;

- Within 7 business days from receipt of an application, the NCC shall notify the applicant in writing that whether the application is proper and valid. If not, the NCC shall notify the applicant in writing and allow them 30 days to make amendments as from the date of notice;

- Within 30 days from receipt of a proper and valid notification dossier, the NCC shall inform the result of preliminary appraisal which can either be that (i)the intended economic concentration is approved; or (ii)the intended economic concentration must further be subject to the process of official appraisal.If NCC fails to arrive at any of the foregoing conclusions within 30 days, the intended economic concentration shall be deemed approved.

- The NCC shall carry out the official appraisal of economic concentration within 90 days as from the date of a notification of preliminary appraisal result, subject to a further maximum 60 days of extension in complicated cases. During this period, the NCC may require the applicant to supplement other documents maximum 2 times;

- Upon completion of official appraisal, the NCC may either decide to:

- approve the economic concentration without conditions; or

- approve the economic concentration subject to conditions set out in Article 42 of the 2018 Law on Competition; or

- prohibit the economic concentration.